Session One – Risk & Context

|

Part 1a – Context: Understanding the distribution and a review of Volatility

|

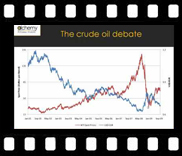

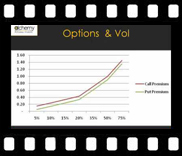

| In part 1a, we see how we may understand the distribution or generator function, the elements that need to be considered when viewing a distribution. We review volatility and the difference between model and market prices. While there is a lot of focus on intricate volatility modelling Jawwad takes a slightly different and more intuitive approach here closer to the Nicholas Nassim Taleb school of thought. |

|

View a sample of part 1a |

Part 1b – Correlations: Why vol is a friend and covariance is not?

|

| In Part 1b, we consider how volatility and correlation may be viewed by a valuation and risk management/ risk control system. We see how increased volatility may be considered a friend to the risk system as it may lead to opportunities to make money. On the other hand we see how a static correlation assumption may be considered a dangerous element to a risk model. In conclusion we consider the importance and effectiveness of having controls and limits on a pre-trade basis rather that the post trade level that we often see in practice. |

|

View a sample of part 1b |

Part 1c – Q&A: The relationship between Optionality, Convexity and Volatility and the fate of the credit manager

|

| In Part 1c, we look at the answers to questions posed earlier in the course. We review duration and convexity; the alternative definition of convexity and its importance to the risk management process, the relationship between options, convexity and volatility. We also provide an answer to the risk manager’s effectiveness question in Part 1a by assessing the distribution of the scores of his credit portfolio and its relationship to a coin toss. |

|

View a sample of 1c |

Session Two: Value at Risk

|

Part 2a – Extending Value at Risk

|

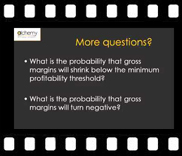

| In Part 2a, we take a detailed look at Value at Risk, VaR. We consider its various definitions and the questions that it may be used to answer. We see how the tool may be extended from its traditional market risk application to other applications such as margin management and profitability calculations. We consider how VaR is used to estimate capital for capital allocation purposes, marginal capital needed for additional investments made, to make comparisons of risk measures over time. We look at the general step-by-step process followed for calculating VaR and an introduction on the difference and uses between Rate VaR and Price VaR for calculating risk on Fixed Income securities. |

|

View a sample of 2a |

Part 2b – Value at Risk: VaR Qualifications

|

| In Part 2b, we continue with our discussion of Value at Risk, VaR, starting with the difference between Price and Rate VaR. We move onto another VaR Case study which looks at the determination of VaR using the historical simulation approach. Next we review in detail the processes behind the calculation of each of the three VaR methods, issues with each method and comparisons between them. We see how the calculation is impacted for a change in the liquidation or holding period assumption. Lastly we look at Nicholas Nassim Talebs views on VaR in particular his rules for risk management. |

|

View a sample of 2b |

Session Three – Capital: Learning to work with capital

|

| In Part 3, we discuss the definitions & types of capital and the shift in paradigm in recent years with regard to capital attribution. We look at how a risk framework may be built around capital and consider an example of how to differentiate between regulatory & economic capital. We consider the structure for building a capital management/ attribution model, developing a risk policy with a focus on capital attribution and risk appetite. Review types of risk for which capital is assessed and the question of capital aggregation. A look at an ICAAP model & framework and review the limits management process of a capital protection framework presenting an overview of the link between transaction and expectation driven limits, a process linking VaR & VaR based limits to Stop Loss and Capital. |

|

View a sample of session three |

Session Four – Limits

|

| In Part 4, we discuss Transaction and Expectation driven limits. We present 4 parts of the limit management framework, counterparty , transaction, exposure and sensitivity limits. Within counterparty limits we focus on Pre-settlement risk limits and its relationship to volatility, Value at Risk and Worst case loss and examples of how this limit is applied to bond, equity and FX transactions. This is followed by a discussion of transaction and exposure limits and their application within a trade, security operating cycle, tenor and risk classification to an individual, trader or desk. Next, we move to sensitivity limits i.e. how the framework applied to counterparty, transaction and exposure limits can be extended in light of changes to exchange rates, interest rates, volatility, earnings, share holder value & capital. |

|

View a sample of session four |

|

| Back to top |