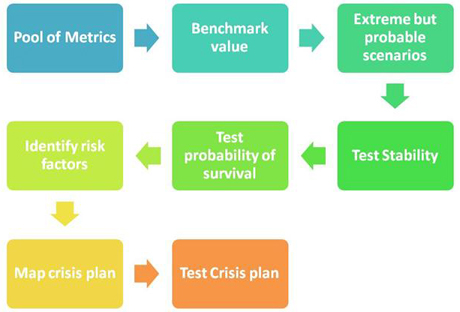

| Besides reviewing the basic and static capital adequacy framework regulators are also keen on testing capital adequacy under a range of scenarios. Some static, some a replay of historical crisis and others that are a simulation of complex interactions between all the market factors that impact the balance sheet of a bank. |

Session Four – Introduction to Asset Liability Management (ALM)

|

| After covering market (price) risk and credit risk, it is now time to take a look at Interest Rate Risk or Maturity Mismatch risk. Before we move on to the topic of bank capital adequacy it is important that we have a good grip on what drives Interest Rate Mismatch and Liquidity risk at a bank.

We use Asset Liability Management as a tool to measure interest rate exposure and introduce the concept of maturity mismatch at a high level. This is quickly followed by an introduction to a simplified ALM framework that we will use as a foundation for the ALM stress testing report we will use in later sessions. |

|

View a sample of session four |

Session Five: Asset Liability Management (ALM)

|

| We continue with more core definitions and introduce the primary questions an ALM framework is expected to answer covering both shareholder value and interest income sensitivity. Starting with duration and convexity we introduce the concept of Asset Sensitivity and Liability Sensitivity before walking through the core steps required for building an ALM model. |

|

View a sample of session five |

Session Six: Asset Liability Management (ALM) Reports

|

| In our last and final session on ALM, we introduce and walk through the Maturity and Rate GAP reports and use them to build and introduce the Earnings at Risk and Market Value of Equity at Risk reports. The session uses an Excel based template to walk participants through the 4 report format, their usage and applications. |

|

View a sample of session six |

Session Seven – Calculating Value at Risk

|

a. Theoretical Overview

|

| We take a detailed look at Value at Risk, VaR. We consider its various definitions and the questions that it may be used to answer. We see how the tool may be extended from its traditional market risk application to other applications such as margin management and profitability calculations. We consider how VaR is used to estimate capital for capital allocation purposes, marginal capital needed for additional investments made, to make comparisons of risk measures over time. We look at the general step-by-step process followed for calculating VaR and an introduction on the difference and uses between Rate VaR and Price VaR for calculating risk on Fixed Income securities. |

|

View a sample of session one |

b. VaR Qualifications

|

| In this session we continue with our discussion of Value at Risk, VaR, starting with the difference between Price and Rate VaR. We move onto another VaR Case study which looks at the determination of VaR using the historical simulation approach. Next we review in detail the processes behind the calculation of each of the three VaR methods, issues with each method and comparisons between them. We see how the calculation is impacted for a change in the liquidation or holding period assumption. Lastly we look at Nicholas Nassim Talebs views on VaR in particular his rules for risk management. |

|

View a sample of session two |

c. Calculating VaR for a single security using VCV and Historical Simulation approaches

|

| A detailed look at Value at Risk, VaR. We consider its various definitions and the questions that it may be used to answer. We see how the tool may be extended from its traditional market risk application to other applications such as margin management and profitability calculations. We consider how VaR is used to estimate capital for capital allocation purposes, marginal capital needed for additional investments made, to make comparisons of risk measures over time. We look at the general step-by-step process followed for calculating VaR and an introduction on the difference and uses between Rate VaR and Price VaR for calculating risk on Fixed Income securities. |

|

View a sample of session three |

d. Extending the VaR model to a portfolio. Calculating portfolio VaR without a VCV matrix

|

| We extend the earlier discussion regarding VaR calculation for currencies to commodities. We then demonstrate how to calculate Value at Risk for a portfolio of securities using both the Variance Covariance (VCV) approach as well as the Historical Simulation Approach. We use a short cut method for the VCV approach that bypasses the need to construct a VCV matrix. However we also cross check the results from this short cut method with those obtained from the matrix method. During this course we demonstrate the use of EXCEL’s in-built TRANSPOSE and MMULT functions. |

|

View a sample of session four |

e. Value at risk for Fixed income securities – Rate and Price VaR; Delta and Full Valuation approaches

|

| We consider its various definitions and the questions that it may be used to answer. We see how the tool may be extended from its traditional market risk application to other applications such as margin management and profitability calculations. We consider how VaR is used to estimate capital for capital allocation purposes, marginal capital needed for additional investments made, to make comparisons of risk measures over time. We look at the general step-by-step process followed for calculating VaR and an introduction on the difference and uses between Rate VaR and Price VaR for calculating risk on Fixed Income securities. |

|

View a sample of session five |

Session Eight: Capital – Learning to work with capital

|

| we discuss the definitions & types of capital and the shift in paradigm in recent years with regard to capital attribution. We look at how a risk framework may be built around capital and consider an example of how to differentiate between regulatory & economic capital. We consider the structure for building a capital management/ attribution model, developing a risk policy with a focus on capital attribution and risk appetite. Review types of risk for which capital is assessed and the question of capital aggregation. A look at an ICAAP model & framework and review the limits management process of a capital protection framework presenting an overview of the link between transaction and expectation driven limits, a process linking VaR & VaR based limits to Stop Loss and Capital. |

|

View a sample of session eight |

Session Nine: Introduction to Capital Adequacy

|

| In our refresher on capital adequacy, we review the origins of capital adequacy regulation and margin of safety in banks starting with Regulation Q and the evolution of the Basel I and Basel II standards over the last 30 years. |

|

View a sample of session nine |

Session Ten: ICAAP (Internal Capital Adequacy Assessment Process) and Liquidity Risk Capital extensions

|

| We review Pillar I, Pillar II requirements as well as a quick walk through the ICAAP (Internal Capital Adequacy Process) and the Basel II liquidity risk extensions. Briefly touch liquidity coverage ratio, net stable funding ratio and integrating correlations within stress testing. |

|

View a sample of session ten |

Session Eleven: Understanding Duration & Convexity

|

| We review duration and convexity; the alternative definition of convexity and its importance to the risk management process, the relationship between options, convexity and volatility. |

|

View a sample of session eleven |

|

| Back to top |